Top Guidelines Of Amur Capital Management Corporation

Top Guidelines Of Amur Capital Management Corporation

Blog Article

Excitement About Amur Capital Management Corporation

Table of ContentsThe Best Strategy To Use For Amur Capital Management CorporationThe Facts About Amur Capital Management Corporation RevealedThe Ultimate Guide To Amur Capital Management CorporationNot known Incorrect Statements About Amur Capital Management Corporation The Best Guide To Amur Capital Management CorporationThe 7-Second Trick For Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You Buy

A reduced P/E proportion might show that a firm is undervalued, or that investors expect the firm to deal with more hard times in advance. Financiers can use the ordinary P/E ratio of other business in the exact same sector to form a standard.

An Unbiased View of Amur Capital Management Corporation

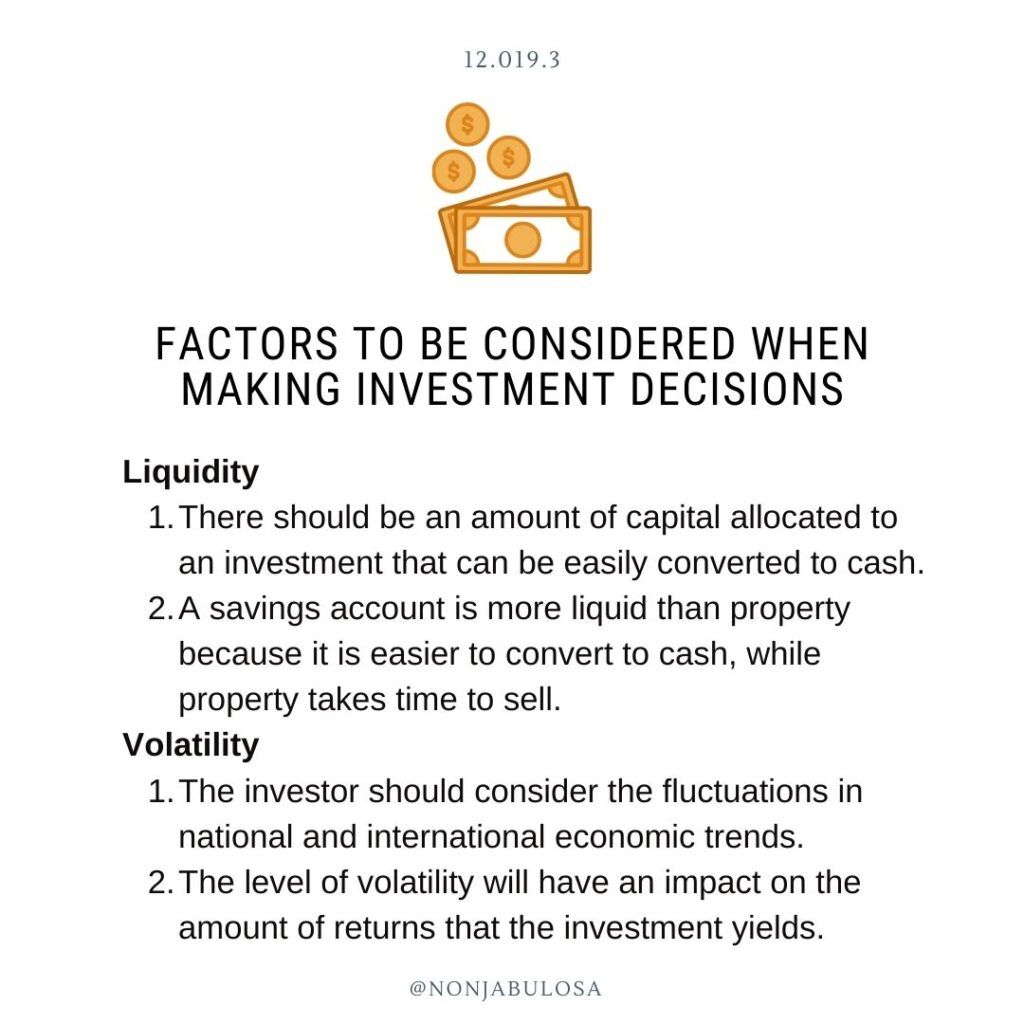

The standard in the vehicle and vehicle industry is just 15. A stock's P/E proportion is easy to find on many monetary reporting web sites. This number suggests the volatility of a supply in comparison to the marketplace as a whole. A safety with a beta of 1 will show volatility that's identical to that of the market.

A stock with a beta of over 1 is in theory more volatile than the market. A security with a beta of 1.3 is 30% more volatile than the market. If the S&P 500 increases 5%, a stock with a beta of 1. https://www.reddit.com/user/amurcapitalmc/.3 can be anticipated to rise by 8%

Amur Capital Management Corporation for Dummies

EPS is a dollar figure representing the section of a firm's profits, after tax obligations and participating preferred stock returns, that is alloted to every share of typical stock. Capitalists can use this number to assess exactly how well a company can deliver worth to shareholders. A higher EPS results in higher share prices.

If a firm consistently stops working to deliver on incomes forecasts, an investor may intend to reassess acquiring the supply - exempt market dealer. The calculation is easy. If a business has an earnings of $40 million and pays $4 million in returns, after that the remaining sum of $36 million is split by the variety of shares outstanding

The Only Guide for Amur Capital Management Corporation

Financiers often get interested in a supply after checking out headlines concerning its sensational performance. Simply keep in mind, that's yesterday's information. Or, as the spending pamphlets always expression it, "Past performance is not a forecaster of future returns." Sound investing choices should take into consideration context. An appearance at the pattern in prices over the previous 52 weeks at the least is essential to get a sense of where a supply's rate may go next.

Technical analysts comb with huge volumes of data in an effort to forecast the instructions of supply prices. Basic evaluation fits the demands of a lot of capitalists and has the benefit of making great feeling in the actual globe.

They believe prices comply with a pattern, and if they can analyze the pattern they can profit from it with well-timed trades. In current years, modern technology has actually enabled even more financiers to practice this design of spending since the devices and the information are a lot more easily accessible than ever. Basic analysts think about the innate worth of a stock.

The Single Strategy To Use For Amur Capital Management Corporation

A number of the ideas reviewed throughout this item prevail in the fundamental expert's world. Technical evaluation is finest fit to somebody that has the time and convenience degree with data to place infinite numbers to utilize. Or else, essential evaluation will fit the requirements of a lot of capitalists, and it has the benefit of making excellent sense in the genuine world.

Broker agent fees and shared fund expense ratios pull money from your portfolio. Those expenditures cost you today and in the future. Over a duration of 20 years, yearly fees of 0.50% on a $100,000 financial investment will decrease the profile's worth by $10,000. Over the exact same duration, a 1% charge will reduce the very same portfolio by $30,000.

The fad is with you (https://www.indiegogo.com/individuals/37861930). Take benefit of the pattern and shop around for the lowest price.

Amur Capital Management Corporation Fundamentals Explained

Closeness to facilities, eco-friendly room, scenic views, and the area's status element prominently right into house assessments. Closeness to markets, warehouses, transport hubs, freeways, and tax-exempt areas play a crucial role in industrial home valuations. A vital when thinking about residential or commercial property place is the mid-to-long-term sight concerning exactly how the area is anticipated to advance over the financial investment duration.

The Amur Capital Management Corporation Ideas

Extensively evaluate the ownership and intended use of the prompt locations where you intend to invest. One means to gather info concerning the potential customers of the location of the property you are taking into consideration is resource to get in touch with the community hall or various other public companies in cost of zoning and urban planning.

Residential property assessment is essential for financing during the purchase, sale price, financial investment analysis, insurance, and taxationthey all depend upon real estate valuation. Commonly utilized genuine estate evaluation approaches include: Sales contrast method: recent equivalent sales of homes with similar characteristicsmost usual and ideal for both brand-new and old properties Expense technique: the expense of the land and building and construction, minus devaluation ideal for new construction Earnings method: based on expected cash money inflowssuitable for services Offered the reduced liquidity and high-value investment in real estate, an absence of quality purposefully may result in unforeseen results, consisting of economic distressespecially if the financial investment is mortgaged. This uses routine revenue and lasting worth recognition. The temperament to be a proprietor is needed to deal with possible conflicts and legal problems, take care of renters, fixing job, etc. This is generally for quick, small to tool profitthe normal residential or commercial property is unfinished and sold at an earnings on conclusion.

Report this page